As the world grapples with the growing threat of climate change, renewable energy sources like solar power have gained significant attention and support. In an effort to encourage the adoption of clean energy technologies, governments around the world have implemented various incentives and tax credits. In the United States, the 2023 Solar Tax Credit is one such initiative aimed at promoting the use of solar energy. For those interested in taking advantage of this incentive, it’s essential to understand the eligibility criteria and application process. To get started, you may need to create a 1040 form online to claim the Solar Tax Credit. This article explores what the 2023 Solar Tax Credit is, how it works, and its potential impact on the renewable energy landscape.

The Basics of the 2023 Solar Tax Credit

The 2023 Solar Tax Credit, also known as the Solar Investment Tax Credit (ITC), is a federal tax credit designed to stimulate investment in solar energy systems. It allows homeowners and businesses to offset a portion of the costs associated with installing solar panels and related equipment. This tax credit can significantly reduce the upfront expenses of going solar, making it a compelling option for many individuals and organizations.

Eligibility and Calculation of the 2023 Solar Tax Credit

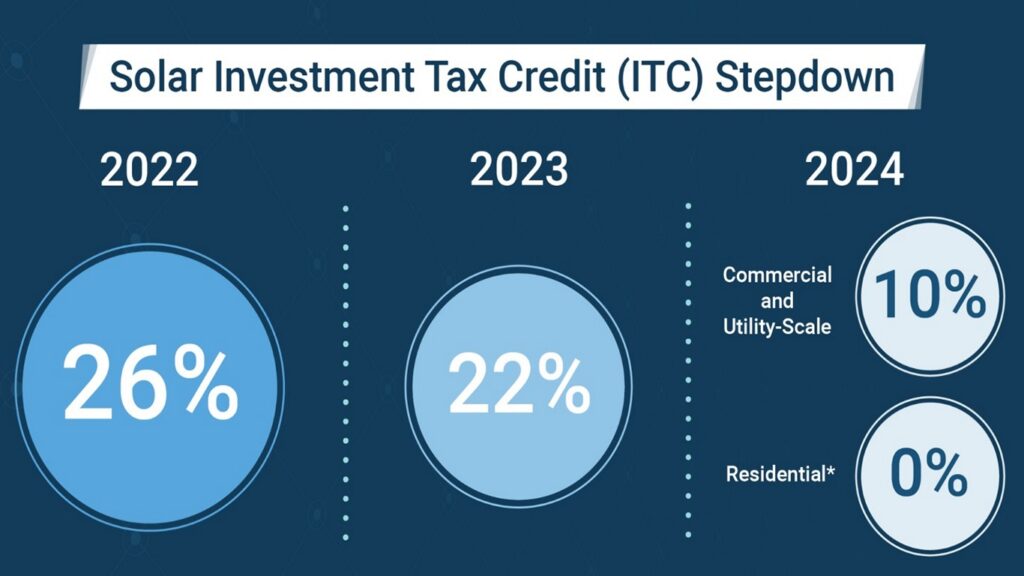

To benefit from the 2023 Solar Tax Credit, individuals and businesses must meet certain eligibility criteria. Eligible solar energy systems must be installed on residential or commercial properties and must be placed in service during the tax year. The tax credit amount is calculated as a percentage of the total qualified expenses incurred during the installation of the solar system. As of 2023, the tax credit provides a 26% credit on the total cost of the solar installation.

For example, if a homeowner spends $20,000 to install a solar panel system on their property, they can claim a tax credit of $5,200 (26% of $20,000). It’s important to note that the tax credit percentage may vary in the future, so staying updated on the latest tax laws is crucial when considering solar investments.

The Advantages and Impact of the 2023 Solar Tax Credit

The 2023 Solar Tax Credit offers several benefits and has significant implications for both individuals and the environment. Firstly, it reduces the financial barrier to adopting solar energy, making it more accessible to a broader range of homeowners and businesses. This, in turn, helps lower greenhouse gas emissions by encouraging the use of clean, renewable energy sources.

Moreover, the tax credit has positive economic implications. It promotes job creation in the solar industry as demand for solar installations grows. Additionally, it stimulates innovation in solar technology and drives competition, which can lead to lower solar system costs over time.

The Future of Solar Energy with the 2023 Tax Credit

In conclusion, the 2023 Solar Tax Credit is a crucial tool for advancing the adoption of solar energy in the United States. It provides financial incentives for individuals and businesses to invest in clean, renewable energy solutions while simultaneously contributing to the fight against climate change. As technology advances and solar becomes more affordable, the tax credit’s impact is expected to grow, further accelerating the transition to a sustainable energy future. However, it’s essential for individuals and organizations interested in harnessing the benefits of this tax credit to act promptly, as the percentage of the credit may decrease in subsequent years. By leveraging the 2023 Solar Tax Credit, we can move closer to a greener, more sustainable world.